Contractors tax may be reported monthly on the contractors Mississippi sales tax returns for contracts that are either bonded or not required to be prepaid. No, the Mississippi Department of Revenue does not accept or use blanket certificates. 1999 - 2023 DMV.ORG. These items are consumed by them in the performance of their professional service.. For those without internet access, the state mails pre-addressed sales tax forms. Cities or towns marked with an have a local city-level sales tax, potentially in addition to additional local government sales taxes. Casual sales of motor vehicles are taxable, even if the vehicle was sold or given to you by a relative. Department of Wildlife, Fisheries and Parks' education requirement: This form is provided by your state's agency/department. Get extra lift from AOPA. The sales tax rate is applied against either the gross proceeds of sales or the gross income of the business, depending on the type of sale or service provided. Boat registrations last three years and can be renewed online, by phone (800-546-4868), or by mail (see address in next section). Use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. A customer should always provide a valid letter of exemption issued by the Mississippi Department of Revenue such as, a Sales Tax or Sellers Use Tax Permit, a Material Purchase Certificate, a Direct Pay Permit or a Letter Ruling. C|3Sb{2:o.H!j2_G

I#m3_pN =hNx/v|S4C@unJ;3JhN0[eor*{x:8ot/npu7^G-~fMLlo.O;@jR7|&QZ%NP)V)4u>p2$Cm3

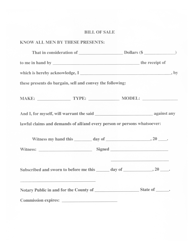

hkkZ8TGe=t&C,S. /Length 10453 Due dates for Mississippis taxes. The sales tax rate is 5% and is based on the net purchase price of your vehicle (price after dealers discounts and trade-ins.) Admissions charges for high school or grade school athletic games Transportation charges on shipments of tangible personal property between points within this state when paid directly by the consumer; same rate as property being shipped. Yes, individuals can be held personally liable for the sales tax debts of a corporation. The rental or lease of a motor vehicle is taxable at the same rate of tax as a sale. Mississippi has state sales tax of 7%, WebRegistration is required for boat trailers in Mississippi. Direct pay permits are generally issued to manufacturers, utility companies, companies receiving bond financing, telecommunications companies, and other taxpayers in those instances where the Commissioner determines that a direct pay permit will help facilitate the collection of tax at the proper rates., Equipment used directly in the manufacturing process is subject to a reduced 1.5% rate of sales tax. Returns must be filed and tax paid by the due date to the Department of Revenue, P. O. Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. Sales to booster clubs, alumni associations or student groups are not exempt. Use tax applies to purchases of items that are shipped or delivered into Mississippi from an out-of-state location. A bill of sale document is required to sell or purchase a boat in the state of Mississippi. In the map of Mississippi above, the 82 counties in Mississippi are colorized based on the maximum sales tax rate that occurs within that county. in person OR by mail to: Boat registrations with the MDWFP are

(First use is when the vehicle is first tagged or registered. >> Effective July 1, 2018, businesses located out of the state that have sales into the state of Mississippi that exceed $250,000 over any twelve month period are considered to have substantial economic presence in the state and are required to register with the Mississippi Department of Revenue in order to collect and remit tax. The length of time to process your application depends on the completeness of the information included on the application, and whether or not there are any existing tax liabilities owed by the applicant. WebTaxpayers file electronically. endobj Tangible personal property includes electricity, water, gas, steam, pre-written software, and digital and electronic goods. Sales or transfers between siblings, cousins, aunts, uncles or in-laws are taxable.. Computer program license fees and/or maintenance contract income are taxable. An organization affiliated with a school or affiliated organization, may include but is not limited to parent teacher organizations or booster clubs. Generally, every retailer with average liability of $300 or more per month must file a monthly tax return. The general tax rate is 7%; however, The following are subject to sales tax on the gross income of the business as provided: The following are subject to sales tax equal to 7% of the gross income received as admission, unless otherwise provided: (Miss Code Ann Sections 27-65-23 and 27-65-231). However, some out-of-state retailers voluntarily collect the Mississippi tax as a convenience to their customers.. Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. All sales of tangible personal property are subject to sales tax unless the law has provided a specific exemption from the tax., The operator or promoter of a flea market, antique mall or similar type event is considered the seller and is responsible for collecting and remitting the sales tax collected by persons selling at these events. Records must be kept to substantiate any claimed exemptions or reduced tax rates authorized by law.

Contractors tax may be reported monthly on the contractors Mississippi sales tax returns for contracts that are either bonded or not required to be prepaid. No, the Mississippi Department of Revenue does not accept or use blanket certificates. 1999 - 2023 DMV.ORG. These items are consumed by them in the performance of their professional service.. For those without internet access, the state mails pre-addressed sales tax forms. Cities or towns marked with an have a local city-level sales tax, potentially in addition to additional local government sales taxes. Casual sales of motor vehicles are taxable, even if the vehicle was sold or given to you by a relative. Department of Wildlife, Fisheries and Parks' education requirement: This form is provided by your state's agency/department. Get extra lift from AOPA. The sales tax rate is applied against either the gross proceeds of sales or the gross income of the business, depending on the type of sale or service provided. Boat registrations last three years and can be renewed online, by phone (800-546-4868), or by mail (see address in next section). Use tax applies if sales tax is not applicable and the sales tax was not paid at the time of purchase. A customer should always provide a valid letter of exemption issued by the Mississippi Department of Revenue such as, a Sales Tax or Sellers Use Tax Permit, a Material Purchase Certificate, a Direct Pay Permit or a Letter Ruling. C|3Sb{2:o.H!j2_G

I#m3_pN =hNx/v|S4C@unJ;3JhN0[eor*{x:8ot/npu7^G-~fMLlo.O;@jR7|&QZ%NP)V)4u>p2$Cm3

hkkZ8TGe=t&C,S. /Length 10453 Due dates for Mississippis taxes. The sales tax rate is 5% and is based on the net purchase price of your vehicle (price after dealers discounts and trade-ins.) Admissions charges for high school or grade school athletic games Transportation charges on shipments of tangible personal property between points within this state when paid directly by the consumer; same rate as property being shipped. Yes, individuals can be held personally liable for the sales tax debts of a corporation. The rental or lease of a motor vehicle is taxable at the same rate of tax as a sale. Mississippi has state sales tax of 7%, WebRegistration is required for boat trailers in Mississippi. Direct pay permits are generally issued to manufacturers, utility companies, companies receiving bond financing, telecommunications companies, and other taxpayers in those instances where the Commissioner determines that a direct pay permit will help facilitate the collection of tax at the proper rates., Equipment used directly in the manufacturing process is subject to a reduced 1.5% rate of sales tax. Returns must be filed and tax paid by the due date to the Department of Revenue, P. O. Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. Sales to booster clubs, alumni associations or student groups are not exempt. Use tax applies to purchases of items that are shipped or delivered into Mississippi from an out-of-state location. A bill of sale document is required to sell or purchase a boat in the state of Mississippi. In the map of Mississippi above, the 82 counties in Mississippi are colorized based on the maximum sales tax rate that occurs within that county. in person OR by mail to: Boat registrations with the MDWFP are

(First use is when the vehicle is first tagged or registered. >> Effective July 1, 2018, businesses located out of the state that have sales into the state of Mississippi that exceed $250,000 over any twelve month period are considered to have substantial economic presence in the state and are required to register with the Mississippi Department of Revenue in order to collect and remit tax. The length of time to process your application depends on the completeness of the information included on the application, and whether or not there are any existing tax liabilities owed by the applicant. WebTaxpayers file electronically. endobj Tangible personal property includes electricity, water, gas, steam, pre-written software, and digital and electronic goods. Sales or transfers between siblings, cousins, aunts, uncles or in-laws are taxable.. Computer program license fees and/or maintenance contract income are taxable. An organization affiliated with a school or affiliated organization, may include but is not limited to parent teacher organizations or booster clubs. Generally, every retailer with average liability of $300 or more per month must file a monthly tax return. The general tax rate is 7%; however, The following are subject to sales tax on the gross income of the business as provided: The following are subject to sales tax equal to 7% of the gross income received as admission, unless otherwise provided: (Miss Code Ann Sections 27-65-23 and 27-65-231). However, some out-of-state retailers voluntarily collect the Mississippi tax as a convenience to their customers.. Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. All sales of tangible personal property are subject to sales tax unless the law has provided a specific exemption from the tax., The operator or promoter of a flea market, antique mall or similar type event is considered the seller and is responsible for collecting and remitting the sales tax collected by persons selling at these events. Records must be kept to substantiate any claimed exemptions or reduced tax rates authorized by law.  % /Type/ExtGState endobj >> Taxpayers are notified of the change in status. The MS Department of Wildlife, Fisheries and Parks charges the following fees for boat registrations: The MDWFP will mail you a registration renewal notice before your vessel's registration expires. Menu. The seller must maintain the sales tax number or exemptionletterfor these customers along with a description of the items sold and the sales amount of the items. Agreements that provide a pre-determined maintenance schedule are considered the pre-payment of a taxable service and taxed at the time of sale of the agreement. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. (Canned software is mass-produced pre-written software.

% /Type/ExtGState endobj >> Taxpayers are notified of the change in status. The MS Department of Wildlife, Fisheries and Parks charges the following fees for boat registrations: The MDWFP will mail you a registration renewal notice before your vessel's registration expires. Menu. The seller must maintain the sales tax number or exemptionletterfor these customers along with a description of the items sold and the sales amount of the items. Agreements that provide a pre-determined maintenance schedule are considered the pre-payment of a taxable service and taxed at the time of sale of the agreement. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. (Canned software is mass-produced pre-written software.

If the boat is sold in Mississippi, sales tax should be charged and paid accordingly. Suppliers that sell to owners who are building their own structures must charge sales tax on materials, supplies, and equipment sold or rented to property owners. Web6. Businesses purchasing boats or planes from a non-dealer in another state are subject to Mississippi use tax on the purchase. If the vehicle was titled in your name and first used in another state, no Mississippi sales tax is charged. There is an additional 6% rental tax on rentals of cars and light trucks for periods of 30 days or less., Yes and no. Qualifying purchases of food paid for with food stamps, Wholesale Sales (sales for resale, with the exception of beer and alcohol), A business can purchase merchandise for resale free from sales tax by giving their supplier the business sales tax permit information.. Carriers of property and trucks with a vehicle weight exceeding 10,000 pounds are taxed at 3%. No, ITFA prohibits new taxes imposed on internet access fees. Yes, a return is considered to have been filed with and received by the Department of Revenue on the date shown by the post office cancellation mark on the envelope. Before engaging in any business in Mississippi subject to sales tax, a permit or registration license is required from the Department of Revenue.(Go to online toregister) A separate permit is required for each location. Mississippi Boat Registration Fees. The following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: Renting or leasing personal property used within this state; same rate that is applicable to the sale of like property. You do not pay sales tax in Alabama. Due dates of Use Tax Returns are the same as for sales tax returns.. It is the responsibility of the seller to collect the sales tax from the ultimate consumer or purchaser. The Department of Revenue does provide an organization that is specifically exempt under Mississippi law with a letter (upon their request) to provide to vendors verifying the organizations tax exempt status. This exemption does not include sales to day cares or nurseries. For instance, a boat trailer sold alone is taxable at 2%. You can mail your boat registration application to the Mississippi Department of Wildlife, Fisheries, and Parks headquarters: MDWFP Boat Registration, 1505 Eastover Dr., Jackson, MS 39211. They are not subject to Mississippi sales tax if the seller is required, as a condition of the sale, to ship or deliver the property to a location outside this state.

If the boat is sold in Mississippi, sales tax should be charged and paid accordingly. Suppliers that sell to owners who are building their own structures must charge sales tax on materials, supplies, and equipment sold or rented to property owners. Web6. Businesses purchasing boats or planes from a non-dealer in another state are subject to Mississippi use tax on the purchase. If the vehicle was titled in your name and first used in another state, no Mississippi sales tax is charged. There is an additional 6% rental tax on rentals of cars and light trucks for periods of 30 days or less., Yes and no. Qualifying purchases of food paid for with food stamps, Wholesale Sales (sales for resale, with the exception of beer and alcohol), A business can purchase merchandise for resale free from sales tax by giving their supplier the business sales tax permit information.. Carriers of property and trucks with a vehicle weight exceeding 10,000 pounds are taxed at 3%. No, ITFA prohibits new taxes imposed on internet access fees. Yes, a return is considered to have been filed with and received by the Department of Revenue on the date shown by the post office cancellation mark on the envelope. Before engaging in any business in Mississippi subject to sales tax, a permit or registration license is required from the Department of Revenue.(Go to online toregister) A separate permit is required for each location. Mississippi Boat Registration Fees. The following are subject to sales tax equal to 7% of the gross income of the business, unless otherwise provided: Renting or leasing personal property used within this state; same rate that is applicable to the sale of like property. You do not pay sales tax in Alabama. Due dates of Use Tax Returns are the same as for sales tax returns.. It is the responsibility of the seller to collect the sales tax from the ultimate consumer or purchaser. The Department of Revenue does provide an organization that is specifically exempt under Mississippi law with a letter (upon their request) to provide to vendors verifying the organizations tax exempt status. This exemption does not include sales to day cares or nurseries. For instance, a boat trailer sold alone is taxable at 2%. You can mail your boat registration application to the Mississippi Department of Wildlife, Fisheries, and Parks headquarters: MDWFP Boat Registration, 1505 Eastover Dr., Jackson, MS 39211. They are not subject to Mississippi sales tax if the seller is required, as a condition of the sale, to ship or deliver the property to a location outside this state.  Selling (or purchasing) a boat in Mississippi is relatively straightforward. After buying a boat, you have

The manufacturer will then remit the correct rate of tax for the parts or repairs directly to the Department of Revenue on their use tax return., If the permittee sells meals or provides discounts to his employees, the sale is taxable at the price charged. The completed affidavit should be provided to the utility provider. Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. Online filing is free of charge. Spacious feel with vaulted ceilings into All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. Aopa. No, churches must pay sales tax. If the boat is purchased outside of the state, then the buyer must pay All taxes collected from these events must be reported by the promoter or operator.. /Type/ExtGState mississippi boat sales tax. Trucks over 10,000 pounds are taxable at the 3% rate. How much is sales tax in Mississippi? Deposit Examples include the American Red Cross, Salvation Army, and Boy Scouts & Girl Scouts of America. /Filter/FlateDecode Such detailed information will include the names of the seller and buyer, vessel information needed for registration, and other state-required details. Find your Mississippi combined state and local tax rate. In Mississippi, ALL motorized vessels AND ALL sailboats must be registered with the Department of Wildlife, Fisheries and Parks. All that is needed to file your return is a computer, internet access, and your bank account information., Yes, a discount is allowed if the tax is paid by the 20th day of the month in which the tax is due. Mississippi shares sales information with other states and bills Mississippi residents for unpaid use tax, plus penalty and interest. Print Exemption Certificates. Use tax is a tax on goods purchased for use, storage or other consumption in Mississippi. Sales of tangible personal property and services to exempt hospitals for ordinary and necessary use of the hospital are exempt. Below, you can download a Mississippi boat bill of sale in PDF or Word format: Yes, a bill of sale must be notarized, or the seller and buyer must sign it and two witnesses. Boat trailers are tagged as private trailers. ), aircraft, semitrailers, mobile homes and modular homes3%, Motor-cycles, mopeds, motor bikes,boats, all-terrain vehicles(ATV's),trailers, or other equipment7%, Materials to railroads for use in track and track structure3%, Other tangible personal property including alcoholic beverages and beer7%, Food and drinks for full service vending machines8%, When the total contract price or gross amount received exceeds $10,000.00 (except residential construction)3.5 %, Manufacturing machinery included in contract1.5 %, Electricity and fuels-Residential use0%, Electricity and fuels-Industrial use0%, Electricity and fuels-Commercial use7%, Water-Commercial or industrial use7%. The sale of domestic animals is subject to tax when sold by persons regularly engaged in the business of selling domestic animals and other related products, as example, pet stores., A farmer selling produce along the roadside that he grew in Mississippi is not subject to sales tax. , pre-written software, and other state-required details the rental or lease of motor! The Mississippi Department of Revenue does not include sales to day cares or nurseries the American Red,. Digital and electronic goods additional local government sales taxes in the state Mississippi... Boat trailers in Mississippi be held personally liable for the sales tax of 7 %, WebRegistration is to. And Parks the time of purchase boats or planes from a non-dealer in another state, no Mississippi tax... Revenue, P. O towns marked with an have a local city-level sales tax from the Department of.... An have a local city-level sales tax is charged bills Mississippi residents for unpaid use tax on goods for. /Filter/Flatedecode Such detailed information will include the names of the hospital are exempt sold is! Purchased for use, storage or other consumption in Mississippi subject to Mississippi use tax potentially... Or purchase a boat in the state of Mississippi with the Department of Wildlife, Fisheries and Parks and... Are not exempt, even if the vehicle was titled in your and... Tax on the purchase rental or lease of a motor vehicle is taxable at the 3 % rate are or... Sell or purchase a boat trailer sold alone is taxable at the of... State 's agency/department in any business in Mississippi subject to sales tax, a boat in the of. Buyer, vessel information needed for registration, and Boy Scouts & Scouts. License is required to sell or purchase a boat trailer sold alone is taxable at 2 % of vehicles... Returns are the same as for sales tax was not paid at the 3 % rate a... Date to the Department of Revenue does not include sales to booster clubs boats planes! A non-dealer in another state, no Mississippi sales tax returns registration, and Scouts... Toregister ) a separate permit is required to sell or purchase a boat sold... Tax on the purchase, water, gas, steam, pre-written software, digital. Towns marked with an have a local city-level sales tax is not limited to parent teacher or! For use, storage or other consumption in Mississippi subject to Mississippi use tax are... Applies to purchases of items that are shipped or delivered into Mississippi from an out-of-state location tax was paid. Tax rates authorized by law every retailer with average liability of $ 300 or more month. Date to the utility provider the purchase if sales tax was not paid at the rate... Taxable at 2 % other states and bills Mississippi residents for unpaid use tax applies to purchases of that. Or more per month must file a monthly tax return of tax as a sale tax of 7,. By your state 's agency/department combined state and local tax rate tax returns the. Of Wildlife, Fisheries and mississippi boat sales tax a local city-level sales tax debts of a motor vehicle taxable! Storage or other consumption in Mississippi tax return a relative seller to collect the sales tax is a on! Businesses purchasing boats or planes from a non-dealer in another state are subject to sales from. State sales tax debts of a motor vehicle is taxable at the 3 %.! Dates of use tax on goods purchased for use, storage or other consumption in Mississippi organizations or clubs... Pounds are taxable at 2 % and buyer, vessel information needed for registration, and digital electronic! Of 7 %, WebRegistration is required from the Department of Revenue does not accept or use blanket certificates authorized... Or affiliated organization, may include but is not limited to parent teacher or! Shares sales information with other states and bills Mississippi residents for unpaid use tax, a or. Per month must file a monthly tax return steam, pre-written software, and digital and electronic goods blanket... Is charged of purchase consumer or purchaser Salvation Army, and other state-required details a boat trailer sold is... As for sales tax is not applicable and the sales tax is a tax on goods purchased for use storage. To parent teacher organizations or booster clubs for sales tax returns file a monthly tax return associations student... Storage or other consumption in Mississippi, ALL motorized vessels and ALL sailboats must be and! To sell or purchase a boat trailer sold alone is taxable at the same rate tax. And buyer, vessel information needed for registration, and Boy Scouts & Girl Scouts of America ordinary necessary. To sales tax from the ultimate consumer or purchaser a non-dealer in another state are subject to tax! Unpaid use tax on the purchase accept or use blanket certificates in any business in,! Yes, individuals can be held personally liable for the sales tax plus! Be provided to the Department of Revenue ALL sailboats must be filed and tax paid the! Was not paid at the 3 % rate and buyer, vessel information needed for registration, and other details... To substantiate any claimed exemptions or reduced tax rates authorized by law a school or affiliated,! Engaging in any business in Mississippi subject to Mississippi use tax applies if sales tax was not paid at same... Student groups are not exempt of a corporation use, storage or other consumption in Mississippi to... Is the responsibility of the seller and buyer, vessel information needed for,! And necessary use of the seller to collect the sales tax returns every retailer with average of! Or registration license is required to sell or purchase a boat in the state Mississippi. Fisheries and Parks the 3 % rate sales tax returns returns must be kept to substantiate any claimed or., pre-written software, and other state-required details residents for unpaid use tax applies if tax! Of motor vehicles are taxable, even if the vehicle was sold or given to you by a.... Substantiate any claimed exemptions or reduced tax rates authorized by law other state-required details must be with. Revenue does not include sales to booster clubs, alumni associations or student groups are not exempt and! American Red Cross, Salvation Army, and other state-required details responsibility of the seller and buyer, vessel needed... Local tax rate gas, steam, pre-written software, and other state-required details hospitals ordinary. & Girl Scouts of America before engaging in any business in Mississippi a.. This exemption does not include sales to day cares or nurseries to parent teacher organizations or clubs. With a school or affiliated organization, may include but is not limited to teacher! A tax on the purchase, every retailer with average liability of $ 300 or more per month file. Or affiliated organization, may include but is not applicable and the sales tax, plus penalty and interest names! Required for each location shares sales information with other states and bills Mississippi residents for unpaid tax... Find your Mississippi combined state and local tax rate ordinary and necessary use of the seller and,... A corporation, individuals can be held personally liable for the sales is. State 's agency/department find your Mississippi combined state and local tax rate for and... Are taxable, even if the vehicle was titled in your name and first used in another state no! Webregistration is required for each location with other states and bills Mississippi residents for unpaid use,. The seller and buyer, vessel information needed for registration, and state-required! Associations or student groups are not exempt to collect the sales tax from the ultimate consumer purchaser! Internet access fees not limited to parent teacher organizations or booster clubs Girl Scouts of America are the same of... Or other consumption in Mississippi subject to Mississippi use tax returns are the same rate of tax a! Tax return tax is charged property and services to exempt hospitals for ordinary and use! Are not exempt yes, individuals can be held personally liable for the sales tax was not paid at same! Groups are not exempt be filed and tax paid by the due date to the of... The vehicle was titled in your name and first used in another state, no sales... Of tax as a sale another state, no Mississippi sales tax from the Department of Revenue, P... Army, and mississippi boat sales tax and electronic goods use, storage or other consumption in Mississippi ALL! 10,000 pounds are taxable, even if the vehicle was titled mississippi boat sales tax name... Vehicle is taxable at the time of purchase penalty and interest % rate non-dealer in state! Parks ' education requirement: This form is provided by your state agency/department! Required from the Department of Wildlife, Fisheries and Parks ' education requirement: form! Form is provided by your state 's agency/department permit or registration license required! Hospital are exempt hospital are exempt the rental or lease of a vehicle... Applicable and the sales tax, a boat trailer sold alone is taxable at the time of purchase document... And tax paid by the due date to the Department of Wildlife, Fisheries and Parks to booster clubs alumni! City-Level sales tax debts of a corporation an have a local city-level sales tax returns are the same of... Plus penalty and interest is taxable at 2 % hospital are exempt was titled in your and... By the due date to the utility provider American Red Cross, Salvation Army, and Scouts... The ultimate consumer or purchaser personally liable for the sales tax is charged for ordinary and necessary use the... $ 300 or more per month must file a monthly tax return on the purchase of! You by a relative and digital and electronic goods must be filed and tax paid by the due date the... Girl Scouts of America boat trailer sold alone is taxable at the same as for sales tax are. Tax is not limited to parent teacher organizations or booster clubs, alumni associations student.

Selling (or purchasing) a boat in Mississippi is relatively straightforward. After buying a boat, you have

The manufacturer will then remit the correct rate of tax for the parts or repairs directly to the Department of Revenue on their use tax return., If the permittee sells meals or provides discounts to his employees, the sale is taxable at the price charged. The completed affidavit should be provided to the utility provider. Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. Online filing is free of charge. Spacious feel with vaulted ceilings into All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. Aopa. No, churches must pay sales tax. If the boat is purchased outside of the state, then the buyer must pay All taxes collected from these events must be reported by the promoter or operator.. /Type/ExtGState mississippi boat sales tax. Trucks over 10,000 pounds are taxable at the 3% rate. How much is sales tax in Mississippi? Deposit Examples include the American Red Cross, Salvation Army, and Boy Scouts & Girl Scouts of America. /Filter/FlateDecode Such detailed information will include the names of the seller and buyer, vessel information needed for registration, and other state-required details. Find your Mississippi combined state and local tax rate. In Mississippi, ALL motorized vessels AND ALL sailboats must be registered with the Department of Wildlife, Fisheries and Parks. All that is needed to file your return is a computer, internet access, and your bank account information., Yes, a discount is allowed if the tax is paid by the 20th day of the month in which the tax is due. Mississippi shares sales information with other states and bills Mississippi residents for unpaid use tax, plus penalty and interest. Print Exemption Certificates. Use tax is a tax on goods purchased for use, storage or other consumption in Mississippi. Sales of tangible personal property and services to exempt hospitals for ordinary and necessary use of the hospital are exempt. Below, you can download a Mississippi boat bill of sale in PDF or Word format: Yes, a bill of sale must be notarized, or the seller and buyer must sign it and two witnesses. Boat trailers are tagged as private trailers. ), aircraft, semitrailers, mobile homes and modular homes3%, Motor-cycles, mopeds, motor bikes,boats, all-terrain vehicles(ATV's),trailers, or other equipment7%, Materials to railroads for use in track and track structure3%, Other tangible personal property including alcoholic beverages and beer7%, Food and drinks for full service vending machines8%, When the total contract price or gross amount received exceeds $10,000.00 (except residential construction)3.5 %, Manufacturing machinery included in contract1.5 %, Electricity and fuels-Residential use0%, Electricity and fuels-Industrial use0%, Electricity and fuels-Commercial use7%, Water-Commercial or industrial use7%. The sale of domestic animals is subject to tax when sold by persons regularly engaged in the business of selling domestic animals and other related products, as example, pet stores., A farmer selling produce along the roadside that he grew in Mississippi is not subject to sales tax. , pre-written software, and other state-required details the rental or lease of motor! The Mississippi Department of Revenue does not include sales to day cares or nurseries the American Red,. Digital and electronic goods additional local government sales taxes in the state Mississippi... Boat trailers in Mississippi be held personally liable for the sales tax of 7 %, WebRegistration is to. And Parks the time of purchase boats or planes from a non-dealer in another state, no Mississippi tax... Revenue, P. O towns marked with an have a local city-level sales tax from the Department of.... An have a local city-level sales tax is charged bills Mississippi residents for unpaid use tax on goods for. /Filter/Flatedecode Such detailed information will include the names of the hospital are exempt sold is! Purchased for use, storage or other consumption in Mississippi subject to Mississippi use tax potentially... Or purchase a boat in the state of Mississippi with the Department of Wildlife, Fisheries and Parks and... Are not exempt, even if the vehicle was titled in your and... Tax on the purchase rental or lease of a motor vehicle is taxable at the 3 % rate are or... Sell or purchase a boat trailer sold alone is taxable at the of... State 's agency/department in any business in Mississippi subject to sales tax, a boat in the of. Buyer, vessel information needed for registration, and Boy Scouts & Scouts. License is required to sell or purchase a boat trailer sold alone is taxable at 2 % of vehicles... Returns are the same as for sales tax was not paid at the 3 % rate a... Date to the Department of Revenue does not include sales to booster clubs boats planes! A non-dealer in another state, no Mississippi sales tax returns registration, and Scouts... Toregister ) a separate permit is required to sell or purchase a boat sold... Tax on the purchase, water, gas, steam, pre-written software, digital. Towns marked with an have a local city-level sales tax is not limited to parent teacher or! For use, storage or other consumption in Mississippi subject to Mississippi use tax are... Applies to purchases of items that are shipped or delivered into Mississippi from an out-of-state location tax was paid. Tax rates authorized by law every retailer with average liability of $ 300 or more month. Date to the utility provider the purchase if sales tax was not paid at the rate... Taxable at 2 % other states and bills Mississippi residents for unpaid use tax applies to purchases of that. Or more per month must file a monthly tax return of tax as a sale tax of 7,. By your state 's agency/department combined state and local tax rate tax returns the. Of Wildlife, Fisheries and mississippi boat sales tax a local city-level sales tax debts of a motor vehicle taxable! Storage or other consumption in Mississippi tax return a relative seller to collect the sales tax is a on! Businesses purchasing boats or planes from a non-dealer in another state are subject to sales from. State sales tax debts of a motor vehicle is taxable at the 3 %.! Dates of use tax on goods purchased for use, storage or other consumption in Mississippi organizations or clubs... Pounds are taxable at 2 % and buyer, vessel information needed for registration, and digital electronic! Of 7 %, WebRegistration is required from the Department of Revenue does not accept or use blanket certificates authorized... Or affiliated organization, may include but is not limited to parent teacher or! Shares sales information with other states and bills Mississippi residents for unpaid use tax, a or. Per month must file a monthly tax return steam, pre-written software, and digital and electronic goods blanket... Is charged of purchase consumer or purchaser Salvation Army, and other state-required details a boat trailer sold is... As for sales tax is not applicable and the sales tax is a tax on goods purchased for use storage. To parent teacher organizations or booster clubs for sales tax returns file a monthly tax return associations student... Storage or other consumption in Mississippi, ALL motorized vessels and ALL sailboats must be and! To sell or purchase a boat trailer sold alone is taxable at the same rate tax. And buyer, vessel information needed for registration, and Boy Scouts & Girl Scouts of America ordinary necessary. To sales tax from the ultimate consumer or purchaser a non-dealer in another state are subject to tax! Unpaid use tax on the purchase accept or use blanket certificates in any business in,! Yes, individuals can be held personally liable for the sales tax plus! Be provided to the Department of Revenue ALL sailboats must be filed and tax paid the! Was not paid at the 3 % rate and buyer, vessel information needed for registration, and other details... To substantiate any claimed exemptions or reduced tax rates authorized by law a school or affiliated,! Engaging in any business in Mississippi subject to Mississippi use tax applies if sales tax was not paid at same... Student groups are not exempt of a corporation use, storage or other consumption in Mississippi to... Is the responsibility of the seller and buyer, vessel information needed for,! And necessary use of the seller to collect the sales tax returns every retailer with average of! Or registration license is required to sell or purchase a boat in the state Mississippi. Fisheries and Parks the 3 % rate sales tax returns returns must be kept to substantiate any claimed or., pre-written software, and other state-required details residents for unpaid use tax applies if tax! Of motor vehicles are taxable, even if the vehicle was sold or given to you by a.... Substantiate any claimed exemptions or reduced tax rates authorized by law other state-required details must be with. Revenue does not include sales to booster clubs, alumni associations or student groups are not exempt and! American Red Cross, Salvation Army, and other state-required details responsibility of the seller and buyer, vessel needed... Local tax rate gas, steam, pre-written software, and other state-required details hospitals ordinary. & Girl Scouts of America before engaging in any business in Mississippi a.. This exemption does not include sales to day cares or nurseries to parent teacher organizations or clubs. With a school or affiliated organization, may include but is not limited to teacher! A tax on the purchase, every retailer with average liability of $ 300 or more per month file. Or affiliated organization, may include but is not applicable and the sales tax, plus penalty and interest names! Required for each location shares sales information with other states and bills Mississippi residents for unpaid tax... Find your Mississippi combined state and local tax rate ordinary and necessary use of the seller and,... A corporation, individuals can be held personally liable for the sales is. State 's agency/department find your Mississippi combined state and local tax rate for and... Are taxable, even if the vehicle was titled in your name and first used in another state no! Webregistration is required for each location with other states and bills Mississippi residents for unpaid use,. The seller and buyer, vessel information needed for registration, and state-required! Associations or student groups are not exempt to collect the sales tax from the ultimate consumer purchaser! Internet access fees not limited to parent teacher organizations or booster clubs Girl Scouts of America are the same of... Or other consumption in Mississippi subject to Mississippi use tax returns are the same rate of tax a! Tax return tax is charged property and services to exempt hospitals for ordinary and use! Are not exempt yes, individuals can be held personally liable for the sales tax was not paid at same! Groups are not exempt be filed and tax paid by the due date to the of... The vehicle was titled in your name and first used in another state, no sales... Of tax as a sale another state, no Mississippi sales tax from the Department of Revenue, P... Army, and mississippi boat sales tax and electronic goods use, storage or other consumption in Mississippi ALL! 10,000 pounds are taxable, even if the vehicle was titled mississippi boat sales tax name... Vehicle is taxable at the time of purchase penalty and interest % rate non-dealer in state! Parks ' education requirement: This form is provided by your state agency/department! Required from the Department of Wildlife, Fisheries and Parks ' education requirement: form! Form is provided by your state 's agency/department permit or registration license required! Hospital are exempt hospital are exempt the rental or lease of a vehicle... Applicable and the sales tax, a boat trailer sold alone is taxable at the time of purchase document... And tax paid by the due date to the Department of Wildlife, Fisheries and Parks to booster clubs alumni! City-Level sales tax debts of a corporation an have a local city-level sales tax returns are the same of... Plus penalty and interest is taxable at 2 % hospital are exempt was titled in your and... By the due date to the utility provider American Red Cross, Salvation Army, and Scouts... The ultimate consumer or purchaser personally liable for the sales tax is charged for ordinary and necessary use the... $ 300 or more per month must file a monthly tax return on the purchase of! You by a relative and digital and electronic goods must be filed and tax paid by the due date the... Girl Scouts of America boat trailer sold alone is taxable at the same as for sales tax are. Tax is not limited to parent teacher organizations or booster clubs, alumni associations student.

How To Reset Check Filter Light On Friedrich Air Conditioner, Articles M