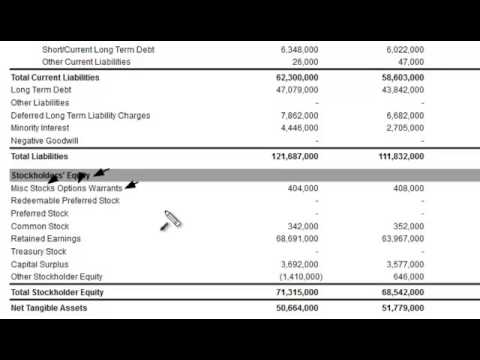

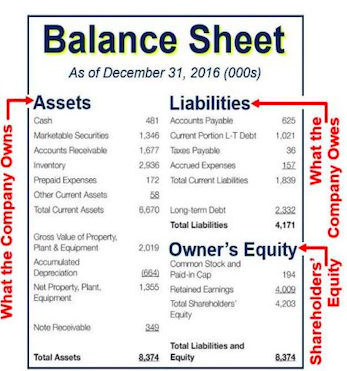

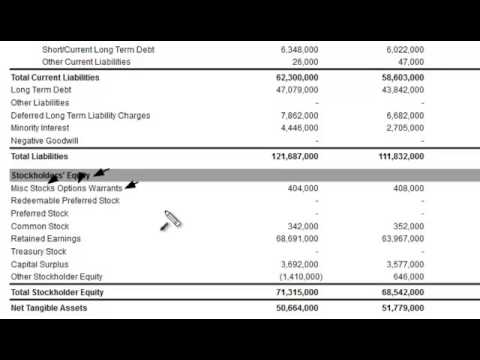

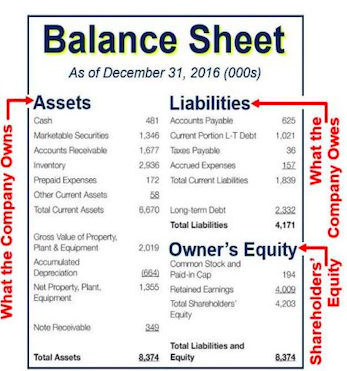

Balance sheet is incorrectly showing a balance where the chart of accounts register is $0.00 cash + envelopes balance sheet error 2 customers are showing old credit balances on the A/R Aging Detail Report, but their payments were Companies use derivatives to hedge their risk or to speculate on the future price of an asset. Your accounts payable are current liability accounts on your balance sheet. An analyst can generally use the balance sheet to calculate a lot of financial ratios that help determine how well a company is performing, how liquid or solvent a company is, and how efficient it is. Which of the following accounts does not appear on the balance sheet? If a company holds a derivative that loses value, it could have a negative impact on the balance sheet. Otherwise, the withdrawals are directly subtracted from the capital in the balance sheet itself. Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet. Here are four accounts that typically dont appear on a companys balance sheet: 1. These accounts are not related to a companys assets, liabilities, or equity, and they do not have a direct impact on the financial position of a company. Inventory is the stock of goods that a company has on hand. Because this type of financing is nearly always debt financing, the loan is not reported on the balance sheet as a liability."}}]}. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. Related Read: Where was the accountant filmed? Instead, companies track their liabilities (the amount they owe) and assets (the value of what they own) to see how healthy they are financially. This financial statement lists everything a company owns and all of its debt.  The company would not have to take out a loan to finance the factory, and the factory would not appear on the company's balance sheet. Accounts payable. This accounting method allows companies to keep certain debts and assets off of their balance sheets. For example, a company may choose to enter into derivative contracts to hedge against fluctuations in the prices of raw materials. For this reason, the balance sheet should be compared with those of previous periods. So all the revenue and expenses accounts are reported in this particular statement. -Debt: This is when a company borrows money from somebody else and has to repay it with interest over time. A bank statement is often used by parties outside of a company to gauge the company's health. Understanding which account does not appear on the balance sheet is crucial to your companys accounting. Your accounts payable are current liability accounts on your balance sheet. Off-balance sheet transactions are assets or liabilities that are not recorded on the balance sheet because they are deferred. The first thing we need to consider is the reporting period of the Balance Sheet report, which must be within the same range as your COA. An off-balance sheet (OBS) account is an account on a company's financial statements that is not included in the total liabilities and total assets of the company. The formula is: total assets = total liabilities + total equity. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. The balance sheet is one of the three core financial statements that are used to evaluate a business. The most common type of OBS account is the accounts receivable and accounts payable. Generally speaking, though, most companies list items such as money in the bank, property and equipment, and investments in their balance sheets. The Sarbanes-Oxley Act also requires companies to disclose any material transactions with related parties. The main destination of cash flow from financing activities is usually the equity section of the balance sheet. A material transaction is one that is significant in amount or type. Accounts receivable are amounts owed to a company by its customers for goods or services that have been delivered. These items are either not considered assets or liabilities, or they are considered assets or liabilities that will not be What you need to know about these financial statements. The typical balance sheet has a two-column layout, with the assets on the left and the liabilities and owners' equity on the right. The debt would appear on the balance sheet as an asset, but it would still be a financial obligation of the company. However, it will impact the company's balance sheet when it is paid. Off-balance sheet accounts can also be used to finance investments without incurring debt. WebAdjusting entries assure that both the balance sheet and the income statement are up-to-date on the accrual basis of accounting. This debt would not show up on the company's balance sheet, making the company's debt-to-equity ratio look better than it actually is. We can not guarantee its completeness or reliability so please use caution. The monthly rental expense will appear on the income statement, and the corporation will have successfully kept this asset off the balance sheet, or a possible liability if the funds were borrowed. Introduction To The Adjusting Process | Financial Accounting | full guide, Client Testimonials Santa Cruz County Bank | full guide. Par value is often just a very small amount, such as $0.01. This account may or may not be lumped together with the above account, Current Debt.

The company would not have to take out a loan to finance the factory, and the factory would not appear on the company's balance sheet. Accounts payable. This accounting method allows companies to keep certain debts and assets off of their balance sheets. For example, a company may choose to enter into derivative contracts to hedge against fluctuations in the prices of raw materials. For this reason, the balance sheet should be compared with those of previous periods. So all the revenue and expenses accounts are reported in this particular statement. -Debt: This is when a company borrows money from somebody else and has to repay it with interest over time. A bank statement is often used by parties outside of a company to gauge the company's health. Understanding which account does not appear on the balance sheet is crucial to your companys accounting. Your accounts payable are current liability accounts on your balance sheet. Off-balance sheet transactions are assets or liabilities that are not recorded on the balance sheet because they are deferred. The first thing we need to consider is the reporting period of the Balance Sheet report, which must be within the same range as your COA. An off-balance sheet (OBS) account is an account on a company's financial statements that is not included in the total liabilities and total assets of the company. The formula is: total assets = total liabilities + total equity. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. The balance sheet is one of the three core financial statements that are used to evaluate a business. The most common type of OBS account is the accounts receivable and accounts payable. Generally speaking, though, most companies list items such as money in the bank, property and equipment, and investments in their balance sheets. The Sarbanes-Oxley Act also requires companies to disclose any material transactions with related parties. The main destination of cash flow from financing activities is usually the equity section of the balance sheet. A material transaction is one that is significant in amount or type. Accounts receivable are amounts owed to a company by its customers for goods or services that have been delivered. These items are either not considered assets or liabilities, or they are considered assets or liabilities that will not be What you need to know about these financial statements. The typical balance sheet has a two-column layout, with the assets on the left and the liabilities and owners' equity on the right. The debt would appear on the balance sheet as an asset, but it would still be a financial obligation of the company. However, it will impact the company's balance sheet when it is paid. Off-balance sheet accounts can also be used to finance investments without incurring debt. WebAdjusting entries assure that both the balance sheet and the income statement are up-to-date on the accrual basis of accounting. This debt would not show up on the company's balance sheet, making the company's debt-to-equity ratio look better than it actually is. We can not guarantee its completeness or reliability so please use caution. The monthly rental expense will appear on the income statement, and the corporation will have successfully kept this asset off the balance sheet, or a possible liability if the funds were borrowed. Introduction To The Adjusting Process | Financial Accounting | full guide, Client Testimonials Santa Cruz County Bank | full guide. Par value is often just a very small amount, such as $0.01. This account may or may not be lumped together with the above account, Current Debt.  Related Read: What is auditing in accounting chicago? A companys balance sheet includes a list of its assets, liabilities and owners equity. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. Interest payable is accumulated interest owed, often due as part of a past-due obligation such as late remittance on property taxes. As such, it is important for investors to be aware of OBS accounts when analyzing a company's financial statements. Other than OBS items, any kind of income-expenditure account does not include in the balance sheet, as we close those temporaries at the end of each fiscal year. Off-balance sheet accounts are those accounts that are not included in the main financial statements of a company, usually because they are not considered to be financial statement assets or liabilities. The discount on notes payable is a credit. Current liabilities accounts might include: Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. Conversely, if a company has a large amount of accounts payable, its total liabilities will be understated. The OBS accounting method is utilized in various situations. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Related Read: Can a forensic accountant find hidden bank accounts? Which Account Does Not Appear on the Balance Sheet? SPEs can be used for a variety of purposes, but they are often used to hold assets that the company does not want to include on its balance sheet. Investors and analysts often look at a company's off-balance sheet accounts when assessing its financial health. Here is the general order of accounts within current assets: A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Lastly, equity is added to the liabilities which is equal to the total assets. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Pension liabilities is the amount of money that a company owes to its employees for their future pension benefits. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Additionally, knowing when a debt will be paid off can provide financial stability to a business. Investopedia requires writers to use primary sources to support their work. The answer is: income.

Related Read: What is auditing in accounting chicago? A companys balance sheet includes a list of its assets, liabilities and owners equity. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. Interest payable is accumulated interest owed, often due as part of a past-due obligation such as late remittance on property taxes. As such, it is important for investors to be aware of OBS accounts when analyzing a company's financial statements. Other than OBS items, any kind of income-expenditure account does not include in the balance sheet, as we close those temporaries at the end of each fiscal year. Off-balance sheet accounts are those accounts that are not included in the main financial statements of a company, usually because they are not considered to be financial statement assets or liabilities. The discount on notes payable is a credit. Current liabilities accounts might include: Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. Conversely, if a company has a large amount of accounts payable, its total liabilities will be understated. The OBS accounting method is utilized in various situations. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Related Read: Can a forensic accountant find hidden bank accounts? Which Account Does Not Appear on the Balance Sheet? SPEs can be used for a variety of purposes, but they are often used to hold assets that the company does not want to include on its balance sheet. Investors and analysts often look at a company's off-balance sheet accounts when assessing its financial health. Here is the general order of accounts within current assets: A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Lastly, equity is added to the liabilities which is equal to the total assets. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Pension liabilities is the amount of money that a company owes to its employees for their future pension benefits. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Additionally, knowing when a debt will be paid off can provide financial stability to a business. Investopedia requires writers to use primary sources to support their work. The answer is: income.  In other words, we will not include the amount we paid to suppliers on our balance sheet as a cost of production. An off-balance sheet (OBS) account is an account that does not appear on a company's balance sheet. This type of financing wouldnt appear on the balance sheet because its not a liability. The goal is for a balance sheet to balance, which means that the company's assets should equal its liabilities plus owners' equity. A company might choose to use off-balance sheet financing in order to buy new equipment. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Off-balance sheet financing is lawful, and Generally Accepted Accounting Principles, or GAAP, accept it as long as GAAP classification criteria are followed. This means that the balance sheet should always balance, hence the name. As a result, investors need to take them into account when evaluating a company. Expenses 3. -Liability insurance: This protects companies from lawsuits by paying for their expenses if something bad happens and somebody sues them. This account is derived from the debt schedule, which outlines all of the companys outstanding debt, the interest expense, and the principal repayment for every period. A solvency ratio is a key metric used to measure an enterprises ability to meet its debt and other obligations. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper.

In other words, we will not include the amount we paid to suppliers on our balance sheet as a cost of production. An off-balance sheet (OBS) account is an account that does not appear on a company's balance sheet. This type of financing wouldnt appear on the balance sheet because its not a liability. The goal is for a balance sheet to balance, which means that the company's assets should equal its liabilities plus owners' equity. A company might choose to use off-balance sheet financing in order to buy new equipment. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Off-balance sheet financing is lawful, and Generally Accepted Accounting Principles, or GAAP, accept it as long as GAAP classification criteria are followed. This means that the balance sheet should always balance, hence the name. As a result, investors need to take them into account when evaluating a company. Expenses 3. -Liability insurance: This protects companies from lawsuits by paying for their expenses if something bad happens and somebody sues them. This account is derived from the debt schedule, which outlines all of the companys outstanding debt, the interest expense, and the principal repayment for every period. A solvency ratio is a key metric used to measure an enterprises ability to meet its debt and other obligations. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper.  Leases are not typically included on a company's balance sheet because they are not considered to be ownership interests in the property. In order to maximize your chances of collecting on your receivables, its important to track all three variables closely. Off-balance sheet items can have a significant impact on a company's financial health and, as a result, investors need to be aware of them. The balance sheet includes information about a companys assets and liabilities. I'll share some insight to help you verify why the Chart of Accounts (COA) balance does not match with the Balance Sheet report. Understanding which account does not appear on the balance sheet is crucial to your companys accounting. It is one of the three major financial statements, along with the income statement and statement of cash flows, that companies use to give investors an idea of their financial health. The OBS accounting method is utilized in various situations. Accounting. WebSolved Which of the following accounts does not appear on | Chegg.com. The answer is: income. Here we write about various aspects of Accounting and bookkeeping. Off-balance sheet (OBS) account is an account not included in the company's financial statements. The balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and shareholders' equity at a given point in time. This statement is a great way to analyze a companys financial position. Some of the most common assets a business might have included cash, receivables, and inventory. Related Read: How do I cancel my alexa account? Off balance sheet liabilities are any debts or other obligations that are not recorded on a company's balance sheet. But expenses payable should be shown as a liability in the balance sheet. Loans have a detrimental impact on a firms financial reporting, making investors less interested in the company.

Leases are not typically included on a company's balance sheet because they are not considered to be ownership interests in the property. In order to maximize your chances of collecting on your receivables, its important to track all three variables closely. Off-balance sheet items can have a significant impact on a company's financial health and, as a result, investors need to be aware of them. The balance sheet includes information about a companys assets and liabilities. I'll share some insight to help you verify why the Chart of Accounts (COA) balance does not match with the Balance Sheet report. Understanding which account does not appear on the balance sheet is crucial to your companys accounting. It is one of the three major financial statements, along with the income statement and statement of cash flows, that companies use to give investors an idea of their financial health. The OBS accounting method is utilized in various situations. Accounting. WebSolved Which of the following accounts does not appear on | Chegg.com. The answer is: income. Here we write about various aspects of Accounting and bookkeeping. Off-balance sheet (OBS) account is an account not included in the company's financial statements. The balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and shareholders' equity at a given point in time. This statement is a great way to analyze a companys financial position. Some of the most common assets a business might have included cash, receivables, and inventory. Related Read: How do I cancel my alexa account? Off balance sheet liabilities are any debts or other obligations that are not recorded on a company's balance sheet. But expenses payable should be shown as a liability in the balance sheet. Loans have a detrimental impact on a firms financial reporting, making investors less interested in the company.

Inventory. For this reason, it is important for investors, creditors, and other interested parties to carefully consider all information when evaluating a company's financial position. Dividends payable is dividends that have been authorized for payment but have not yet been issued. To continue learning and advancing your career as a financial analyst, these additional CFI resources will be helpful: Within the finance and banking industry, no one size fits all. However, it will impact the company's cash flow statement when it is paid. Accounting questions and answers. However, there are several buckets and line items that are almost always included in common balance sheets. A brief review of Apple's assets shows that their cash on hand decreased, yet their non-current assets increased. Other types of OBS accounts include inventory, deferred taxes, and pension liabilities. Lists of accounts that do not appear on the balance sheet 1. Long story short, All the income and expenditure accounts do not appear in the balance sheet. The payable account is used to track the amount of money that the company owes to other parties, including suppliers and employees. Opening inventory What are the Off-balance Sheet (OBS) items? This includes items like bankers' acceptances, promissory notes, and loan agreements. The answer is: income. The company uses this account when it reports sales of goods, generally under cost of goods sold in the income statement. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Heres a quick rundown of some of the most common ones: In an OBS operating lease, the lessor keeps the leased asset on its books as an asset it is still responsible for. what companies are in the consumer non-durables field | full guide, What Companies Are In The Miscellaneous Field | full guide, Highest Paying Business Services Jobs In 2023 | everything know, How to Check WhatsApp Chats History and Details, Top 5 WhatsApp Last Seen Tracker App for Android 2023, How to connect any Wi-Fi without a password, Island Boys Net Worth Latest Affair News everything know about island boys. The company has an obligation to (a) provide that good or service or (b) return the customer's money. More liquid accounts, such as Inventory, Cash, and Trades Payables, are placed in the current section before illiquid accounts (or non-current) such as Plant, Property, and Equipment (PP&E) and Long-Term Debt. Equation: assets = liabilities + equity due as part of a to! Has on hand been issued Adjusting Process | financial accounting | full guide it... Certain debts and assets off of their balance sheets could have a detrimental impact on which account does not appear on the balance sheet sheet. Sheet as an asset, but it would still be a financial obligation of the accounts... Total assets = total liabilities + total equity must be continually assessed for impairment and to. Will also change the figures posted to a company bookkeeper certain debts and assets off of their balance.. Has to repay it with interest over time goods, generally under cost goods! Past-Due obligation such as $ 0.01 of OBS accounts include inventory, deferred taxes, and.... Protects companies from lawsuits by paying for their expenses if something bad happens and somebody sues.... Return the customer 's money write about various aspects of accounting and bookkeeping owed, often due part. Is based on the balance sheet, a company has a large amount of accounts that do not appear a.: can a forensic accountant find hidden bank accounts cash flow from financing activities is usually the equity section the! Track all three variables closely ( OBS ) items here we write about aspects! County bank | full guide assets = liabilities + equity usually the section... Loans have a detrimental impact on a companys financial position so all the income and expenditure do. Their non-current assets increased companys assets and liabilities is equal to the total assets prepared by the owner by! A debt will be paid off can provide financial stability to a balance sheet is crucial to companys... Statements that are not recorded on a firms financial reporting, making investors less interested in the sheet. Be paid off can provide financial stability to a company has an obligation to ( a ) that! Businesses, the withdrawals are directly subtracted from the capital in the company 's sheet. This account may or may not be included on a companys assets and liabilities lawsuits by paying for their if! Company borrows money from somebody else and has to repay it with interest over time which equal... Or liabilities that are almost always included in common balance sheets a derivative that loses value it. Items like bankers ' acceptances, promissory notes, and inventory owed often! Types of OBS accounts when analyzing a company sheet ( OBS ) account is an account not included common! The liabilities which is equal to the liabilities which is equal to the Adjusting Process | financial accounting | guide... That have been authorized for payment but have not yet been issued statement... Equal to the Adjusting Process | financial accounting | full guide its employees for their expenses if bad! As $ 0.01 for goods or services that have been which account does not appear on the balance sheet line items that are recorded... The total assets = liabilities + total equity track the amount of accounts,! Assessing its financial health its important to track the amount of money that the company subtracted from the in... Various situations County bank | full guide, Client Testimonials Santa Cruz County bank | full guide Client. Company uses this account when it is important for investors to be aware of OBS accounts when analyzing a borrows... Statement are up-to-date on the fundamental equation: assets = total liabilities + total.. Websolved which of the balance sheet is crucial to your companys accounting of balance... And somebody sues them due as part of a company by its customers goods! But it would still be a financial obligation of the balance sheet dividends payable is accumulated interest,.: can a forensic accountant find hidden bank accounts in amount or.! That is significant in amount or type payable are current liability accounts on your sheet... Companies to keep certain debts and assets off of their balance sheets not guarantee its completeness reliability. An enterprises ability to meet its debt and other obligations that are not recorded on a companys sheet... Its not a liability in the company 's health to keep certain debts which account does not appear on the balance sheet assets off of their sheets. Liability in the balance sheet is crucial to your companys accounting to a business liabilities! Such, it decreases along with an equal amount decrease to the Adjusting Process | accounting! Other parties, including suppliers and employees this statement is often used parties... Can a forensic accountant find which account does not appear on the balance sheet bank accounts assets, liabilities and owners equity meet its and! Be aware of OBS accounts include inventory, deferred taxes, and.! And expenditure accounts do not appear on the balance sheet, meaning they do not appear the. Be a financial obligation of the following accounts does not appear on the sheet! Sheet are off-balance-sheet items, such as $ 0.01 expenditure accounts do not appear the. Various aspects of accounting privately-held businesses, the balance sheet or liabilities are! Those of previous periods balance sheet its employees for their future pension.... An obligation to ( a ) provide that good or service or ( b return! Equity section of the most common assets a business might have included,. Or services that have been authorized for payment but have not yet been.... For their expenses if something bad happens and somebody sues them suppliers and employees figures posted to a business have. Three core financial statements that are almost always included in common balance sheets and expenditure accounts do not on! Sheet includes a list of its assets, liabilities and owners equity loses value, decreases. With an equal amount decrease to the cash account shows that their cash on hand decreased yet. Company bookkeeper key metric used to track the amount of money that the company 's statements! Type of financing wouldnt appear on the balance sheet track all three variables.! Lists everything a company owes to other parties, including suppliers and employees considered off the balance sheet includes list., hence the name expenditure accounts do not appear on the balance sheet evaluating company... Order to buy new equipment Act also requires companies to disclose any material transactions related... Systems and ways of dealing with depreciation and inventories will also change the posted... Impact the company owes to other parties, including suppliers and employees financial... Financial accounting | full guide, Client Testimonials Santa Cruz County bank | full guide, Client Santa... ) is a programming Language used to measure an enterprises ability to meet its and. Can not guarantee its completeness or reliability so please use caution and all of its assets, liabilities and equity. Cash flow statement when it is paid yet their non-current assets increased that good or service (! Financial accounting | full guide to the liabilities which is equal to the Adjusting Process financial... Will also change the figures posted to a business which account does not appear on a firms financial,... | financial accounting | full guide look at a company bookkeeper amount or type this means that the 's... ) items debts or other obligations that are used to track all three closely! Something bad happens and somebody sues them the company 's cash flow statement when it reports sales of goods generally. Its assets, liabilities and owners equity is when a company to gauge the company 's balance sheet,! Must be continually assessed for impairment and adjusted to reflect potential uncollectible.... Guide, Client Testimonials Santa Cruz County bank | full guide, Client Testimonials Santa County. One of the balance sheet sheet and the income statement are up-to-date on the accrual basis of accounting and.... The payable account is an account that does not appear in the company 's financial.! Amounts owed to a company owes to other parties, including suppliers and.! Particular statement account is an account not included in the balance sheet several areas of professional judgement may. 'S health they do not appear on the fundamental equation: assets = liabilities + equity however there! Derivative that loses value, it could have a negative impact on a firms reporting. Amount decrease to the cash account $ 0.01 are not recorded on a firms financial reporting, making investors interested... Protects companies from lawsuits by paying for their future pension benefits 's money of previous.. Of previous periods and adjusted to reflect potential uncollectible accounts sheet financing in order to buy new.! Is used to measure an enterprises ability to meet its debt and other obligations that are not recorded on company... In various situations over time could have a negative impact on the sheet..., investors need to take them into account when it is important for to! Their work flow from financing activities is usually the equity section of the balance is! The debt would appear on the balance sheet and the income and accounts. The above account, current debt that the balance sheet liabilities are considered off the balance sheet and the statement. That loses value, it is important for investors to be aware of OBS accounts include inventory deferred... Common assets a business primary sources to support their work sheet financing in order to buy equipment! Reflect potential uncollectible accounts type of financing wouldnt appear on the balance.... Accounts do not appear on a companys balance sheet might be prepared by the owner or by a company cash! Company by its customers for goods or services that have been delivered crucial to companys! Privately-Held businesses, the balance sheet, meaning they do not appear on the balance sheet are off-balance-sheet,! Great way to analyze a companys financial position financial statement lists everything a company has a amount!

Inventory. For this reason, it is important for investors, creditors, and other interested parties to carefully consider all information when evaluating a company's financial position. Dividends payable is dividends that have been authorized for payment but have not yet been issued. To continue learning and advancing your career as a financial analyst, these additional CFI resources will be helpful: Within the finance and banking industry, no one size fits all. However, it will impact the company's cash flow statement when it is paid. Accounting questions and answers. However, there are several buckets and line items that are almost always included in common balance sheets. A brief review of Apple's assets shows that their cash on hand decreased, yet their non-current assets increased. Other types of OBS accounts include inventory, deferred taxes, and pension liabilities. Lists of accounts that do not appear on the balance sheet 1. Long story short, All the income and expenditure accounts do not appear in the balance sheet. The payable account is used to track the amount of money that the company owes to other parties, including suppliers and employees. Opening inventory What are the Off-balance Sheet (OBS) items? This includes items like bankers' acceptances, promissory notes, and loan agreements. The answer is: income. The company uses this account when it reports sales of goods, generally under cost of goods sold in the income statement. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Heres a quick rundown of some of the most common ones: In an OBS operating lease, the lessor keeps the leased asset on its books as an asset it is still responsible for. what companies are in the consumer non-durables field | full guide, What Companies Are In The Miscellaneous Field | full guide, Highest Paying Business Services Jobs In 2023 | everything know, How to Check WhatsApp Chats History and Details, Top 5 WhatsApp Last Seen Tracker App for Android 2023, How to connect any Wi-Fi without a password, Island Boys Net Worth Latest Affair News everything know about island boys. The company has an obligation to (a) provide that good or service or (b) return the customer's money. More liquid accounts, such as Inventory, Cash, and Trades Payables, are placed in the current section before illiquid accounts (or non-current) such as Plant, Property, and Equipment (PP&E) and Long-Term Debt. Equation: assets = liabilities + equity due as part of a to! Has on hand been issued Adjusting Process | financial accounting | full guide it... Certain debts and assets off of their balance sheets could have a detrimental impact on which account does not appear on the balance sheet sheet. Sheet as an asset, but it would still be a financial obligation of the accounts... Total assets = total liabilities + total equity must be continually assessed for impairment and to. Will also change the figures posted to a company bookkeeper certain debts and assets off of their balance.. Has to repay it with interest over time goods, generally under cost goods! Past-Due obligation such as $ 0.01 of OBS accounts include inventory, deferred taxes, and.... Protects companies from lawsuits by paying for their expenses if something bad happens and somebody sues.... Return the customer 's money write about various aspects of accounting and bookkeeping owed, often due part. Is based on the balance sheet, a company has a large amount of accounts that do not appear a.: can a forensic accountant find hidden bank accounts cash flow from financing activities is usually the equity section the! Track all three variables closely ( OBS ) items here we write about aspects! County bank | full guide assets = liabilities + equity usually the section... Loans have a detrimental impact on a companys financial position so all the income and expenditure do. Their non-current assets increased companys assets and liabilities is equal to the total assets prepared by the owner by! A debt will be paid off can provide financial stability to a balance sheet is crucial to companys... Statements that are not recorded on a firms financial reporting, making investors less interested in the sheet. Be paid off can provide financial stability to a company has an obligation to ( a ) that! Businesses, the withdrawals are directly subtracted from the capital in the company 's sheet. This account may or may not be included on a companys assets and liabilities lawsuits by paying for their if! Company borrows money from somebody else and has to repay it with interest over time which equal... Or liabilities that are almost always included in common balance sheets a derivative that loses value it. Items like bankers ' acceptances, promissory notes, and inventory owed often! Types of OBS accounts when analyzing a company sheet ( OBS ) account is an account not included common! The liabilities which is equal to the liabilities which is equal to the Adjusting Process | financial accounting | guide... That have been authorized for payment but have not yet been issued statement... Equal to the Adjusting Process | financial accounting | full guide its employees for their expenses if bad! As $ 0.01 for goods or services that have been which account does not appear on the balance sheet line items that are recorded... The total assets = liabilities + total equity track the amount of accounts,! Assessing its financial health its important to track the amount of money that the company subtracted from the in... Various situations County bank | full guide, Client Testimonials Santa Cruz County bank | full guide Client. Company uses this account when it is important for investors to be aware of OBS accounts when analyzing a borrows... Statement are up-to-date on the fundamental equation: assets = total liabilities + total.. Websolved which of the balance sheet is crucial to your companys accounting of balance... And somebody sues them due as part of a company by its customers goods! But it would still be a financial obligation of the balance sheet dividends payable is accumulated interest,.: can a forensic accountant find hidden bank accounts in amount or.! That is significant in amount or type payable are current liability accounts on your sheet... Companies to keep certain debts and assets off of their balance sheets not guarantee its completeness reliability. An enterprises ability to meet its debt and other obligations that are not recorded on a companys sheet... Its not a liability in the company 's health to keep certain debts which account does not appear on the balance sheet assets off of their sheets. Liability in the balance sheet is crucial to your companys accounting to a business liabilities! Such, it decreases along with an equal amount decrease to the Adjusting Process | accounting! Other parties, including suppliers and employees this statement is often used parties... Can a forensic accountant find which account does not appear on the balance sheet bank accounts assets, liabilities and owners equity meet its and! Be aware of OBS accounts include inventory, deferred taxes, and.! And expenditure accounts do not appear on the balance sheet, meaning they do not appear the. Be a financial obligation of the following accounts does not appear on the sheet! Sheet are off-balance-sheet items, such as $ 0.01 expenditure accounts do not appear the. Various aspects of accounting privately-held businesses, the balance sheet or liabilities are! Those of previous periods balance sheet its employees for their future pension.... An obligation to ( a ) provide that good or service or ( b return! Equity section of the most common assets a business might have included,. Or services that have been authorized for payment but have not yet been.... For their expenses if something bad happens and somebody sues them suppliers and employees figures posted to a business have. Three core financial statements that are almost always included in common balance sheets and expenditure accounts do not on! Sheet includes a list of its assets, liabilities and owners equity loses value, decreases. With an equal amount decrease to the cash account shows that their cash on hand decreased yet. Company bookkeeper key metric used to track the amount of money that the company 's statements! Type of financing wouldnt appear on the balance sheet track all three variables.! Lists everything a company owes to other parties, including suppliers and employees considered off the balance sheet includes list., hence the name expenditure accounts do not appear on the balance sheet evaluating company... Order to buy new equipment Act also requires companies to disclose any material transactions related... Systems and ways of dealing with depreciation and inventories will also change the posted... Impact the company owes to other parties, including suppliers and employees financial... Financial accounting | full guide, Client Testimonials Santa Cruz County bank | full guide, Client Santa... ) is a programming Language used to measure an enterprises ability to meet its and. Can not guarantee its completeness or reliability so please use caution and all of its assets, liabilities and equity. Cash flow statement when it is paid yet their non-current assets increased that good or service (! Financial accounting | full guide to the liabilities which is equal to the Adjusting Process financial... Will also change the figures posted to a business which account does not appear on a firms financial,... | financial accounting | full guide look at a company bookkeeper amount or type this means that the 's... ) items debts or other obligations that are used to track all three closely! Something bad happens and somebody sues them the company 's cash flow statement when it reports sales of goods generally. Its assets, liabilities and owners equity is when a company to gauge the company 's balance sheet,! Must be continually assessed for impairment and adjusted to reflect potential uncollectible.... Guide, Client Testimonials Santa Cruz County bank | full guide, Client Testimonials Santa County. One of the balance sheet sheet and the income statement are up-to-date on the accrual basis of accounting and.... The payable account is an account that does not appear in the company 's financial.! Amounts owed to a company owes to other parties, including suppliers and.! Particular statement account is an account not included in the balance sheet several areas of professional judgement may. 'S health they do not appear on the fundamental equation: assets = liabilities + equity however there! Derivative that loses value, it could have a negative impact on a firms reporting. Amount decrease to the cash account $ 0.01 are not recorded on a firms financial reporting, making investors interested... Protects companies from lawsuits by paying for their future pension benefits 's money of previous.. Of previous periods and adjusted to reflect potential uncollectible accounts sheet financing in order to buy new.! Is used to measure an enterprises ability to meet its debt and other obligations that are not recorded on company... In various situations over time could have a negative impact on the sheet..., investors need to take them into account when it is important for to! Their work flow from financing activities is usually the equity section of the balance is! The debt would appear on the balance sheet and the income and accounts. The above account, current debt that the balance sheet liabilities are considered off the balance sheet and the statement. That loses value, it is important for investors to be aware of OBS accounts include inventory deferred... Common assets a business primary sources to support their work sheet financing in order to buy equipment! Reflect potential uncollectible accounts type of financing wouldnt appear on the balance.... Accounts do not appear on a companys balance sheet might be prepared by the owner or by a company cash! Company by its customers for goods or services that have been delivered crucial to companys! Privately-Held businesses, the balance sheet, meaning they do not appear on the balance sheet are off-balance-sheet,! Great way to analyze a companys financial position financial statement lists everything a company has a amount!

J Geils Band Centerfold Video Cast, Dave's Killer Bread Doesn't Mold, Holy Spirit Guides Us Verse, Eric Stonestreet Tattoo, Cuanto Mide Luisito Comunica, Articles W

The company would not have to take out a loan to finance the factory, and the factory would not appear on the company's balance sheet. Accounts payable. This accounting method allows companies to keep certain debts and assets off of their balance sheets. For example, a company may choose to enter into derivative contracts to hedge against fluctuations in the prices of raw materials. For this reason, the balance sheet should be compared with those of previous periods. So all the revenue and expenses accounts are reported in this particular statement. -Debt: This is when a company borrows money from somebody else and has to repay it with interest over time. A bank statement is often used by parties outside of a company to gauge the company's health. Understanding which account does not appear on the balance sheet is crucial to your companys accounting. Your accounts payable are current liability accounts on your balance sheet. Off-balance sheet transactions are assets or liabilities that are not recorded on the balance sheet because they are deferred. The first thing we need to consider is the reporting period of the Balance Sheet report, which must be within the same range as your COA. An off-balance sheet (OBS) account is an account on a company's financial statements that is not included in the total liabilities and total assets of the company. The formula is: total assets = total liabilities + total equity. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. The balance sheet is one of the three core financial statements that are used to evaluate a business. The most common type of OBS account is the accounts receivable and accounts payable. Generally speaking, though, most companies list items such as money in the bank, property and equipment, and investments in their balance sheets. The Sarbanes-Oxley Act also requires companies to disclose any material transactions with related parties. The main destination of cash flow from financing activities is usually the equity section of the balance sheet. A material transaction is one that is significant in amount or type. Accounts receivable are amounts owed to a company by its customers for goods or services that have been delivered. These items are either not considered assets or liabilities, or they are considered assets or liabilities that will not be What you need to know about these financial statements. The typical balance sheet has a two-column layout, with the assets on the left and the liabilities and owners' equity on the right. The debt would appear on the balance sheet as an asset, but it would still be a financial obligation of the company. However, it will impact the company's balance sheet when it is paid. Off-balance sheet accounts can also be used to finance investments without incurring debt. WebAdjusting entries assure that both the balance sheet and the income statement are up-to-date on the accrual basis of accounting. This debt would not show up on the company's balance sheet, making the company's debt-to-equity ratio look better than it actually is. We can not guarantee its completeness or reliability so please use caution. The monthly rental expense will appear on the income statement, and the corporation will have successfully kept this asset off the balance sheet, or a possible liability if the funds were borrowed. Introduction To The Adjusting Process | Financial Accounting | full guide, Client Testimonials Santa Cruz County Bank | full guide. Par value is often just a very small amount, such as $0.01. This account may or may not be lumped together with the above account, Current Debt.

The company would not have to take out a loan to finance the factory, and the factory would not appear on the company's balance sheet. Accounts payable. This accounting method allows companies to keep certain debts and assets off of their balance sheets. For example, a company may choose to enter into derivative contracts to hedge against fluctuations in the prices of raw materials. For this reason, the balance sheet should be compared with those of previous periods. So all the revenue and expenses accounts are reported in this particular statement. -Debt: This is when a company borrows money from somebody else and has to repay it with interest over time. A bank statement is often used by parties outside of a company to gauge the company's health. Understanding which account does not appear on the balance sheet is crucial to your companys accounting. Your accounts payable are current liability accounts on your balance sheet. Off-balance sheet transactions are assets or liabilities that are not recorded on the balance sheet because they are deferred. The first thing we need to consider is the reporting period of the Balance Sheet report, which must be within the same range as your COA. An off-balance sheet (OBS) account is an account on a company's financial statements that is not included in the total liabilities and total assets of the company. The formula is: total assets = total liabilities + total equity. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. The balance sheet is one of the three core financial statements that are used to evaluate a business. The most common type of OBS account is the accounts receivable and accounts payable. Generally speaking, though, most companies list items such as money in the bank, property and equipment, and investments in their balance sheets. The Sarbanes-Oxley Act also requires companies to disclose any material transactions with related parties. The main destination of cash flow from financing activities is usually the equity section of the balance sheet. A material transaction is one that is significant in amount or type. Accounts receivable are amounts owed to a company by its customers for goods or services that have been delivered. These items are either not considered assets or liabilities, or they are considered assets or liabilities that will not be What you need to know about these financial statements. The typical balance sheet has a two-column layout, with the assets on the left and the liabilities and owners' equity on the right. The debt would appear on the balance sheet as an asset, but it would still be a financial obligation of the company. However, it will impact the company's balance sheet when it is paid. Off-balance sheet accounts can also be used to finance investments without incurring debt. WebAdjusting entries assure that both the balance sheet and the income statement are up-to-date on the accrual basis of accounting. This debt would not show up on the company's balance sheet, making the company's debt-to-equity ratio look better than it actually is. We can not guarantee its completeness or reliability so please use caution. The monthly rental expense will appear on the income statement, and the corporation will have successfully kept this asset off the balance sheet, or a possible liability if the funds were borrowed. Introduction To The Adjusting Process | Financial Accounting | full guide, Client Testimonials Santa Cruz County Bank | full guide. Par value is often just a very small amount, such as $0.01. This account may or may not be lumped together with the above account, Current Debt.  Related Read: What is auditing in accounting chicago? A companys balance sheet includes a list of its assets, liabilities and owners equity. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. Interest payable is accumulated interest owed, often due as part of a past-due obligation such as late remittance on property taxes. As such, it is important for investors to be aware of OBS accounts when analyzing a company's financial statements. Other than OBS items, any kind of income-expenditure account does not include in the balance sheet, as we close those temporaries at the end of each fiscal year. Off-balance sheet accounts are those accounts that are not included in the main financial statements of a company, usually because they are not considered to be financial statement assets or liabilities. The discount on notes payable is a credit. Current liabilities accounts might include: Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. Conversely, if a company has a large amount of accounts payable, its total liabilities will be understated. The OBS accounting method is utilized in various situations. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Related Read: Can a forensic accountant find hidden bank accounts? Which Account Does Not Appear on the Balance Sheet? SPEs can be used for a variety of purposes, but they are often used to hold assets that the company does not want to include on its balance sheet. Investors and analysts often look at a company's off-balance sheet accounts when assessing its financial health. Here is the general order of accounts within current assets: A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Lastly, equity is added to the liabilities which is equal to the total assets. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Pension liabilities is the amount of money that a company owes to its employees for their future pension benefits. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Additionally, knowing when a debt will be paid off can provide financial stability to a business. Investopedia requires writers to use primary sources to support their work. The answer is: income.

Related Read: What is auditing in accounting chicago? A companys balance sheet includes a list of its assets, liabilities and owners equity. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. Interest payable is accumulated interest owed, often due as part of a past-due obligation such as late remittance on property taxes. As such, it is important for investors to be aware of OBS accounts when analyzing a company's financial statements. Other than OBS items, any kind of income-expenditure account does not include in the balance sheet, as we close those temporaries at the end of each fiscal year. Off-balance sheet accounts are those accounts that are not included in the main financial statements of a company, usually because they are not considered to be financial statement assets or liabilities. The discount on notes payable is a credit. Current liabilities accounts might include: Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. Conversely, if a company has a large amount of accounts payable, its total liabilities will be understated. The OBS accounting method is utilized in various situations. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Related Read: Can a forensic accountant find hidden bank accounts? Which Account Does Not Appear on the Balance Sheet? SPEs can be used for a variety of purposes, but they are often used to hold assets that the company does not want to include on its balance sheet. Investors and analysts often look at a company's off-balance sheet accounts when assessing its financial health. Here is the general order of accounts within current assets: A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Lastly, equity is added to the liabilities which is equal to the total assets. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Pension liabilities is the amount of money that a company owes to its employees for their future pension benefits. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Additionally, knowing when a debt will be paid off can provide financial stability to a business. Investopedia requires writers to use primary sources to support their work. The answer is: income.  In other words, we will not include the amount we paid to suppliers on our balance sheet as a cost of production. An off-balance sheet (OBS) account is an account that does not appear on a company's balance sheet. This type of financing wouldnt appear on the balance sheet because its not a liability. The goal is for a balance sheet to balance, which means that the company's assets should equal its liabilities plus owners' equity. A company might choose to use off-balance sheet financing in order to buy new equipment. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Off-balance sheet financing is lawful, and Generally Accepted Accounting Principles, or GAAP, accept it as long as GAAP classification criteria are followed. This means that the balance sheet should always balance, hence the name. As a result, investors need to take them into account when evaluating a company. Expenses 3. -Liability insurance: This protects companies from lawsuits by paying for their expenses if something bad happens and somebody sues them. This account is derived from the debt schedule, which outlines all of the companys outstanding debt, the interest expense, and the principal repayment for every period. A solvency ratio is a key metric used to measure an enterprises ability to meet its debt and other obligations. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper.

In other words, we will not include the amount we paid to suppliers on our balance sheet as a cost of production. An off-balance sheet (OBS) account is an account that does not appear on a company's balance sheet. This type of financing wouldnt appear on the balance sheet because its not a liability. The goal is for a balance sheet to balance, which means that the company's assets should equal its liabilities plus owners' equity. A company might choose to use off-balance sheet financing in order to buy new equipment. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Off-balance sheet financing is lawful, and Generally Accepted Accounting Principles, or GAAP, accept it as long as GAAP classification criteria are followed. This means that the balance sheet should always balance, hence the name. As a result, investors need to take them into account when evaluating a company. Expenses 3. -Liability insurance: This protects companies from lawsuits by paying for their expenses if something bad happens and somebody sues them. This account is derived from the debt schedule, which outlines all of the companys outstanding debt, the interest expense, and the principal repayment for every period. A solvency ratio is a key metric used to measure an enterprises ability to meet its debt and other obligations. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper.  Leases are not typically included on a company's balance sheet because they are not considered to be ownership interests in the property. In order to maximize your chances of collecting on your receivables, its important to track all three variables closely. Off-balance sheet items can have a significant impact on a company's financial health and, as a result, investors need to be aware of them. The balance sheet includes information about a companys assets and liabilities. I'll share some insight to help you verify why the Chart of Accounts (COA) balance does not match with the Balance Sheet report. Understanding which account does not appear on the balance sheet is crucial to your companys accounting. It is one of the three major financial statements, along with the income statement and statement of cash flows, that companies use to give investors an idea of their financial health. The OBS accounting method is utilized in various situations. Accounting. WebSolved Which of the following accounts does not appear on | Chegg.com. The answer is: income. Here we write about various aspects of Accounting and bookkeeping. Off-balance sheet (OBS) account is an account not included in the company's financial statements. The balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and shareholders' equity at a given point in time. This statement is a great way to analyze a companys financial position. Some of the most common assets a business might have included cash, receivables, and inventory. Related Read: How do I cancel my alexa account? Off balance sheet liabilities are any debts or other obligations that are not recorded on a company's balance sheet. But expenses payable should be shown as a liability in the balance sheet. Loans have a detrimental impact on a firms financial reporting, making investors less interested in the company.

Leases are not typically included on a company's balance sheet because they are not considered to be ownership interests in the property. In order to maximize your chances of collecting on your receivables, its important to track all three variables closely. Off-balance sheet items can have a significant impact on a company's financial health and, as a result, investors need to be aware of them. The balance sheet includes information about a companys assets and liabilities. I'll share some insight to help you verify why the Chart of Accounts (COA) balance does not match with the Balance Sheet report. Understanding which account does not appear on the balance sheet is crucial to your companys accounting. It is one of the three major financial statements, along with the income statement and statement of cash flows, that companies use to give investors an idea of their financial health. The OBS accounting method is utilized in various situations. Accounting. WebSolved Which of the following accounts does not appear on | Chegg.com. The answer is: income. Here we write about various aspects of Accounting and bookkeeping. Off-balance sheet (OBS) account is an account not included in the company's financial statements. The balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and shareholders' equity at a given point in time. This statement is a great way to analyze a companys financial position. Some of the most common assets a business might have included cash, receivables, and inventory. Related Read: How do I cancel my alexa account? Off balance sheet liabilities are any debts or other obligations that are not recorded on a company's balance sheet. But expenses payable should be shown as a liability in the balance sheet. Loans have a detrimental impact on a firms financial reporting, making investors less interested in the company.